Investment banking is a popular route post-MBA—both for individuals with a pre-MBA background in investment banking and for those who hope to transition into investment banking from other industries.

In this article, we discuss how pursuing an MBA can help your career in investment banking, and offer advice on choosing the right MBA program for you.

Without a doubt, investment banking is one of the most sought-after careers for MBA graduates. And for good reason!

Investment banking offers competitive salaries, career advancement, and exit opportunities due to the skills professionals develop in the role, such as financial modeling, client management, industry expertise, or M&A strategy.

However, the role is extremely complex, and you will need skills in several areas in order to be a successful investment banker. Your responsibilities will include:

Although the responsibilities of an investment banker are wide-reaching and the role requires an in-depth knowledge of several fields, including finance, accounting, M&A, and much more, pursuing an MBA can help you fortify your foundation to transition into or advance within the investment banking industry.

An MBA provides several resources for individuals interested in becoming investment bankers, including:

By taking advantage of all that an MBA program has to offer, aspiring investment bankers will have every opportunity to improve their candidacy within this extremely competitive field.

Our free, comprehensive checklist covers everything you need to shop for an MBA admissions consultant.

For people entering investment banking from a different career path, business school is a good time to fill your skill gaps. This is especially relevant to applicants who come from non-business backgrounds, such as military veterans.

A specialization in banking, such as the one offered at NYU Stern or the Investment Banking Immersion at Cornell Johnson, can seriously improve the candidacy of someone coming from outside of the investment banking industry.

If you would rather not narrow your focus as much, you could simply take advanced courses in finance such as Valuation Principles, Corporate Finance, and Advanced Financial Statement Analysis.

In order to remain a generalist, however, investment banking MBA candidates could consider taking advanced courses in finance, such as:

Of course, individuals with pre-MBA experience in investment banking can use relevant coursework to improve their soft skills, including leadership and communication.

Courses like Stanford GSB‘s “Interpersonal Dynamics”—or Touchy Feely, for those in the know—and Harvard Business School‘s “Motivation and Incentives” can elevate an MBA candidates soft skills, priming them for effective leadership throughout their career.

For aspiring investment bankers, the number one advantage of obtaining an MBA degree is arguably the recruitment opportunities available to MBA students.

Initially, MBA students will have the opportunity to approach investment banks through their MBA summer internship. Investment banks visit MBA programs to host info sessions and sometimes arrange visits by MBA students to the banks’ offices.

Further, many senior bankers choose to hire individuals from the graduating classes of the business school they attended. Thus, an MBA from a top business school can make you a better candidate for highly competitive investment banks.

Are you curious about which banks recruit at MBA programs? We’ve analyzed the data in our article on post-MBA job placements in investment banking.

Nearly every MBA program offers an Investment Banking or Investment Management Club.

In these clubs, second-year students who have completed their banking internships and students who worked full-time in investment banks before enrolling in MBA programs can teach you about the everything from hedge funds and asset management to the investment banking recruiting process.

Further, most investment banking clubs invite guest speakers and host events for those hoping to get into investment banking post-MBA to network and build connections with alumni in the industry. MBA students can also benefit from cross-club collaboration—for instance, connecting with individuals from private equity firms can give you an advantage in spotting investment trends, which can be applied to investment banking.

For individuals working in investment banking pre-MBA, the network you obtain through an MBA program will be of the utmost value in your post-MBA investment banking career.

You will have first refusal for a host of opportunities that would otherwise have escaped you from outside your network, and members of your cohort will consider you ahead of others when looking for investment opportunities.

The same rings true for those hoping to transition into investment banking: with a robust and active alumni network, you will have a significant advantage over your peers in pursuing competitive investment and recruitment opportunities.

Investment banking positions are highly desirable and financially rewarding for MBA grads, which makes it extremely competitive field. And without a business background or banking experience, it can be hard to break into the finance industry without an MBA, especially top investment banks.

The level at which you can enter investment banking will depend on how much relevant or transferable experience you have, alongside the quality and prestige of the MBA degree you achieve—so choosing which MBA program is a big decision.

Those starting their post-MBA careers at an investment bank can expect extremely high starting salaries, with significant signing bonuses. Further, signing bonuses can sometimes equal—or even exceed—an investment banker’s signing bonus.

Entry-level investment banking jobs include:

Obtaining an MBA degree affords many advancement opportunities in investment banking, and those with pre-MBA experience can expect to move more quickly into senior positions and even higher salaries.

Post-MBA investment banking jobs for those with industry experience include:

However, the primary differentiator between post-MBA investment banking roles with an MBA and experience will be the type and size of investment bank you can work at—namely, bulge-bracket, middle-market, and elite boutique firms.

However, the primary differentiator between post-MBA investment banking roles with an MBA and experience will be the type and size of investment bank you can work at—namely, bulge-bracket, middle-market, and elite boutique firms.

The main divisions within investment banks consist of industry coverage groups and financial product groups.

Industry coverage groups in investment banks possess extensive knowledge and expertise in particular industries or market sectors, such as technology or healthcare. These groups establish and nurture relationships with companies operating in various industries, aiming to win mandates for the bank.

On the other hand, investment banks’ product groups focus on specific financial products, such as equity capital markets, debt capital markets, M&A advisory, corporate restructurings, and other specialties.

It is generally agreed that the bulge-bracket firms include:

These large banks work for the largest corporate clients and provide a full range of financial services. While they are extremely competitive, they also employ a comparatively large number of MBA graduates, so the right degree can substantially improve your employment prospects at these firms.

Elite boutiques also provide advice on large transactions, but they do not offer the same capital markets services that bulge-bracket banks do. Some notable elite boutiques include:

Finally, middle-market banks work with smaller companies on smaller transactions. Middle-market banks can be a useful stepping stone for individuals with less relevant experience but with the drive to progress in the investment banking industry.

Middle-market investment banking firms include:

An MBA degree also opens up excellent exit opportunities, including roles in private equity, hedge fund management, venture capital, and financial advisory.

Ultimately, the best MBA program for a career in investment banking is the program that will most effectively nurture your knowledge, skills, and connections to make you the most desirable investment banker you can be.

However, choosing the right MBA program requires a lot of consideration, as the MBA degree with which you graduate can define the remainder of your career and earning potential.

As a result, with their famed curricula, world-renowned instructors, and esteemed alumni networks, the top MBA programs are difficult to surpass in terms of post-MBA investment banking outcomes.

Within the top MBA programs, certain business schools are worth highlighting.

Columbia Business School, for instance, with its enviable New York City location and strong investment banking network is an obvious choice for aspiring investment bankers.

With its stellar finance courses and strong connections to influential figures within the industry, a Columbia MBA can set you up for a successful investment banking career.

New York University’s Stern School of Business is another top choice for those interested in investment banking careers for many of the same reasons as Columbia Business School: its connection to New York City, its finance courses, and its strong investment banking network.

NYU Stern also offers a Banking specialization within the Finance department, allowing individuals to tailor their MBA specifically to target the investment banking industry after graduation.

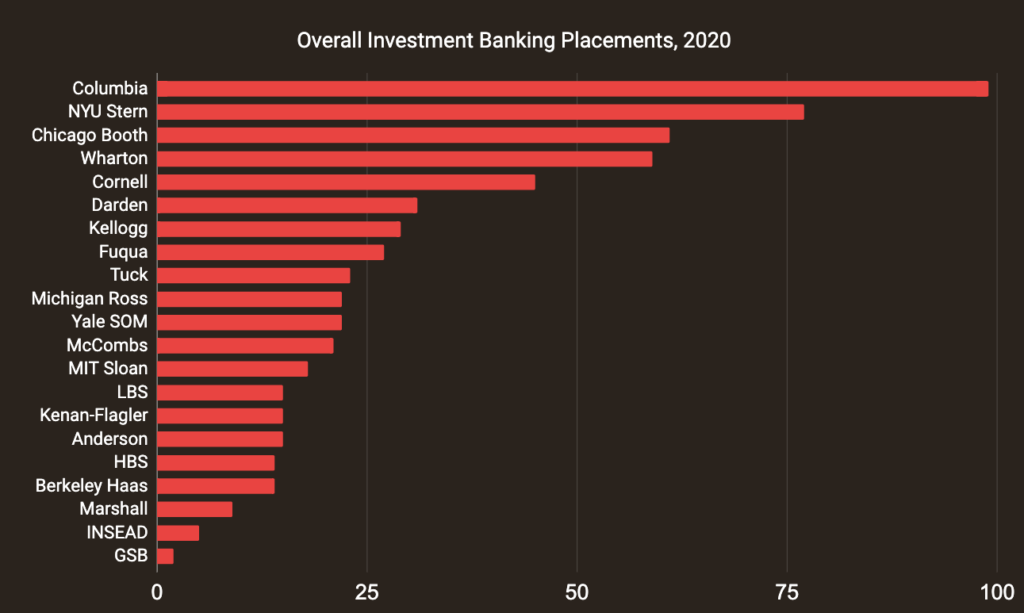

While Stern and Columbia, along with Wharton and Booth, have the highest numbers of investment banking placements post-MBA, they are not the only programs which will significantly improve your prospects in investment banking.

Duke Fuqua also stands out in terms of investment banking placements, with an impressive 93% of its post-MBA banking placements securing positions at bulge-bracket investment banks.

Michigan Ross follows closely in second place, achieving an impressive 82%.

Investment banking is a popular and competitive route for MBA applicants. With the variety and responsibility involved in the role, investment banking can be a demanding career—but it is not without its benefits! Investment bankers can expect an interesting career and highly competitive salaries.

Depending on your pre-MBA experience and the degree you achieve, aspiring investment bankers will have different post-MBA opportunities—from middle-market investment analysts to bulge-bracket vice presidents.

One of the primary methods through which you can improve your investment banking career prospects is to secure your spot in a top MBA program (Book a free consultation with Menlo Coaching). However, you will also have to take into consideration culture and fit, specific relevant coursework, and the industry connections you will need to gain.

Speaking with an MBA admissions consultant can help you choose the right MBA programs to apply to based on your unique profile, and working with a coach can drastically improve your chances of acceptance.