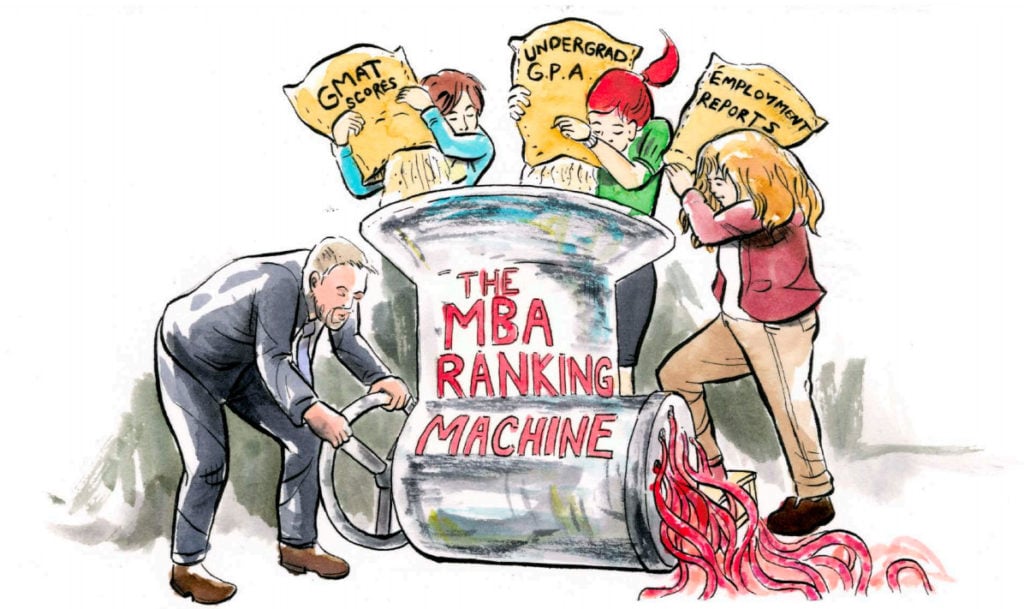

Choosing the right MBA program is one of the most important decisions in your professional career. Before you start using rankings to make this decision, shouldn’t you learn a little bit about how they work?

As you would expect from a magazine like Forbes, the Best Business Schools ranking focuses mostly on the financial aspects of an MBA. In fact, the ranking is completely based on what Forbes calls the “five-year MBA gain.” This means that they calculate how much the average graduate has gained (financially) five years out of their program when compared to a person who did not attend an MBA program.

We agree that an MBA is a financial investment, but we have some quibbles with the Forbes ranking methodology and suggest that applicants use our directory of top MBA programs to find the details like employment statistics that really drive the financial ROI of a top MBA.

| 1. | Booth |

| 2. | Stanford |

| 3. | Kellogg |

| 4. | Harvard |

| 5. | Wharton |

| 6. | Tuck |

| 7. | Columbia |

| 7. | MIT |

| 9. | Cornell |

| 10. | Ross |

| 11. | Haas |

| 11. | Yale |

| 13. | Darden |

| 14. | Fuqua |

| 15. | UNC Kenan–Flagler |

| 16. | UCLA |

| 17. | Tepper |

| 18. | McCombs |

| 19. | Kelley |

| 20. | NYU Stern |

| 21. | Marshall |

| 21. | Goizueta |

| 23. | Foster |

| 24. | Marriott |

| 25. | Mendoza |

Forbes surveyed over 4,000 graduates from the top MBA programs to compile its list, asking questions about their compensation both pre- and post-MBA. From this, they calculated the five-year gain per school, which is the sum of the total compensation minus tuition, fees, and forgone compensation. The total compensation includes salary, bonuses, and exercised stock options.

To achieve a high ranking here, a couple of factors have to align. First, the post-MBA compensation needs to be good, but it is not the most important metric. For instance, Kellogg posts only the 7th-highest post-MBA compensation, but still ranks 3rd overall. This is due to the fact that Kellogg has the lowest pre-MBA compensation of the top eight schools, combined with lower tuition costs than the five schools ranked directly below it.

Therefore, a low pre-MBA compensation and low tuition costs are also necessary to rank high on the Forbes listing.

There are more than a few deficiencies in the Forbes ranking. First of all, the five-year mark, on which the entire list depends, is very arbitrary. Choosing a higher or lower number of years would significantly affect the ranking: the further away from graduation, the greater the influence of post-MBA compensation on rank. Likewise, the tuition rate becomes less important with each passing year.

Also consider that the value of an MBA will last much longer than five years and might in some cases payoff only after the five-year mark.

Second, Forbes normalizes salaries for cost of living, which inflates the rankings of certain MBA programs. Take, for example, business schools that place a significant number of graduates in Chicago–Booth, Kellogg, and Ross. Because the cost of living in Chicago is lower than in NYC, and starting salaries at companies like McKinsey, Bain, and BCG are the same across all offices nationally, Chicago-based programs receive a higher score for post-MBA compensation. But this does NOT reflect better career placements by Booth, Kellogg and Ross when compared to East Coast schools such as HBS, Wharton and Columbia. It is merely selection bias: MBA students who wish to work in Chicago are more likely to attend MBA programs in Chicago. No one believes that getting an MBB job in Chicago is a “better” career outcome vs. getting an MBB job in NYC.

Third, Forbes makes a dubious assumption when calculating the development of the pre-MBA compensation: “We assume that compensation would have risen half as fast as their post-MBA salary increases had these alumni not attended business school.” It is of course difficult to predict what would have happened if someone had not attended business school, but this is a major caveat to the list.

Fourth, the fact that Forbes only takes into account exercised stock options will disproportionally favor some schools over others. Haas has a lot of placements in the tech industry, where stock options are a regular form of compensation. Some of these stock options will not have been exercised within the five years that Forbes considers, which could explain why Haas is ranked relatively low.

There is one aspect of the Forbes ranking that could, at first, be seen as a positive feature. That is, by relying on a five-year window, the ranking necessarily lags behind other lists. Put another way, because Forbes considers the compensation starting five years after graduation, it accounts for change over a longer period of time.

This is desirable because serious changes to the quality of an MBA program require, at minimum, a few years. It takes time for an MBA program to recruit new faculty, build relationships with new post-MBA employers, and raise donations from alumni to support expanded resources for the students. By publishing a new ranking every year, ranking organizations contribute to the false narrative that business schools are constantly undergoing significant changes in quality.

But keep in mind that the Forbes ranking, unlike those from other organizations, does not factor general quality into its evaluation—financial return is the only consideration. So while the five-year window would appear at first glance to provide a more accurate assessment, it is in fact inconsequential to on this point.

When consulting rankings, the potential MBA applicant may be struck by the dramatic differences between each list. How can a school school rise and fall so markedly across rankings that are presumably measuring the same thing?

By analyzing specific entries from different rankings, we see how these lists do not measure the same thing at all: wildly inconsistent methodologies lead to wildly inconsistent results. We also begin to see how, for each ranking, the arbitrary decision to highlight one aspect of the MBA experience will favor certain programs and penalize others.

One of the most well-regarded MBA rankings is that of U.S. News. The methodology they employ can be found on our U.S. News MBA ranking page. In summary, U.S. News ranks business schools on many different qualities, including salary, educational scores, and a peer assessment by deans of other business schools. This difference in approach has led to some very interesting discrepancies with the Forbes listing:

| Forbes Ranking | U.S. News Ranking | |

|---|---|---|

| Tuck | 6th | 12th |

| Cornell | 9th | 15th |

| UNC Kenan–Flagler | 15th | 20th |

| NYU Stern | 20th | 10th |

The most extreme difference between Forbes and U.S. News can be seen in the ranking of NYU Stern: 20th vs. 10th. This is especially curious, as according to U.S. News, Stern has the 2nd-highest starting salary in the top 25 business schools, whereas Stern’s average total compensation five years after graduation is not even in the top 10. This could come down to Forbes‘s five-year lag, as discussed previously. The low compensation combined with the 5th-highest tuition explains NYU’s low ranking.

Cornell scores significantly higher in the Forbes ranking than on other lists. This can be explained by the large number of placements at investment banks, which are generally high-paying jobs. This, in combination with a low pre-MBA average compensation, means that Cornell cracks the top 10 on the Forbes ranking.

Apart from the specific differences between the rankings of the individual schools, there is also a conceptual difference between these two rankings. The U.S. News ranking tries to rank the total experiential value of the MBA, where the Forbes ranking is focused on the final, financial outcome. In theory, U.S. News would rank a school that adds no value for its graduates higher than a school that does add value. On the Forbes ranking, however, a school that adds no value would rank incredibly poorly.

As another US-focused ranking, Businessweek is often consulted alongside Forbes. Here, the same question arises: How can the Businessweek and Forbes rankings vary so widely? The full breakdown of Businessweek’s methodology can be found on the Businessweek MBA ranking page. In summary, most of the Businessweek data is qualitative rather than quantitative, measuring four weighted categories: Compensation, Networking, Learning, and Entrepreneurship.

Some of the most noticeable discrepancies are selected in the following table:

| Forbes Ranking | Businessweek Ranking | |

|---|---|---|

| Kellogg | 3rd | 10th |

| Ross | 10th | 17th |

| Darden | 13th | 5th |

| Fuqua | 14th | 20th |

The difference across the rankings above can be explained by looking at the weighted categories assigned by Businessweek. The Compensation ranking matches the Forbes ranking quite well, as is expected. The other sub-rankings, however, are a scattershot.

Kellogg, for example, comes in 26th on Learning and 45th on Entrepreneurship in the Businessweek ranking, which brings it to 10th overall. This, despite the fact that it boasts an impressive 3rd on the Forbes list.

Darden ranks 12th on Compensation for the Businessweek subranking, which matches the Forbes ranking quite well. But 2nd place in Learning and 4th place in Networking pushes Darden up to a remarkable 5th-place listing according to Businessweek.

In summary, Forbes considers financial value alone when evaluating US business schools. For this reason, its list differs from other US-focused ranking bodies, including U.S. News and Businessweek. Depending on your priorities, the Forbes ranking might be a useful list for initial research—but keep in mind that the five-year window for financial return is incredibly arbitrary, and it severely limits the scope of the ranking.

Once you determine roughly which schools you are qualified to attend—and the rankings can definitely help you get a start on this initial list—we encourage you to leave the rankings behind and instead focus on the practical questions that will help you figure out which MBA program will provide value to your career. These are simple, practical questions:

Answering these questions will help you find an MBA program that can enhance your career.

Amid the noise of MBA rankings, trust in our reliable MBA admissions consultants to help you discern the best path for your academic and professional aspirations.